In this blog post, you will learn:

- The main types of retail data and what they represent.

- How to use retail data and why it drives better decision-making.

- The main obstacles in collecting retail data, and why relying on a retail data provider is the best way to overcome them.

- The aspects to consider when evaluating such providers.

- A detailed comparison of the top retail data providers across these aspects.

Let’s dive in!

TL;DR: A Snapshot of the Best Retail Data Providers

| Provider | Infrastructure | Available Data Sources | Historical Data | Real-Time Data Scraping | AI Integrations | GDPR Compliance | Free Sample/Trial | Pricing |

|---|---|---|---|---|---|---|---|---|

| Bright Data | Enterprise-ready, cloud-based, 150M+ proxy IPs, unlimited concurrency | Amazon, Walmart, Google Shopping, AliExpress, Target, IKEA, Shopee, TikTok Shop, and many more | ✅ | ✅ | 70+ AI frameworks + MCP | ✅ | ✅ | $1.50/1k records for scraping; $2.50/1k for datasets |

| GroupBWT | Enterprise-grade APIs | Amazon, Walmart, eBay, Sephora, Zalando, Target, Best Buy, Costco, and a few more | ✅ | ✅ | Basic | ✅ | ❌ | Custom pricing |

| Retail Scrape | API-based web scraping | Amazon, Myntra, Walmart, eBay, Best Buy, Shopware, Alibaba, and more | ✅ | ✅ | Built-in AI-driven price optimization and predictive analytics | ✅ | ❌ | Custom pricing |

| Data.gov | Government portal with manual download and API access | US federal, state, and city retail datasets | ✅ | ❌ | AI/ML training | ✅ (U.S. Federal Data Strategy) | ✅ | Free |

| Roboflow | Cloud-based computer vision platform | User-uploaded visual datasets | ✅ | ❌ | AI/ML training and workflow building | — (Depends on usage) | ✅ | Subscription-based (free, $99/mo, custom pricing) |

| Dataseeders | Managed web scraping | Undisclosed retail websites and mobile apps worldwide | ✅ | ✅ | Basic | ❌ | ❌ | Custom pricing |

What Retail Data Represents: Main Types

Retail data is a broad term covering the facts, metrics, and insights collected from retailers about operations, sales, products, customers, and market performance. More in detail, the main types of retail data include:

- Transaction data: Records of individual purchases, including date, time, price, and payment method.

- Pricing data: Information on product prices, discounts, and historical changes across retailers.

- Customer data: Data on shopper demographics, contact details, and purchase history, etc.

- Sales data: Aggregated performance metrics such as units sold, revenue, and sell-through rates.

- Inventory data: Real-time visibility into stock levels, availability, and SKU performance.

- Product data: Structured information on products, including attributes like brand, size, color, and category.

- Promotions and marketing data: Details on campaigns, discounts, coupons, and featured placements.

- Store and location data: Information about physical store locations, formats, and operating hours.

- Supply chain and logistics data: Stats on warehouses, shipping times, and distribution performance.

- Behavioral data: Insights into how users interact with retail websites or apps, such as pages viewed or carts abandoned, and similar metrics.

How Retail Data Drives Better Decisions

Retail is one of the largest and fastest-growing industries in the world. The United States alone generated over $7 trillion in retail revenue, led by global giants like Walmart, Amazon, and Costco. Europe ranks as the third-largest retail ecommerce market worldwide, with revenues of $631.9 billion, projected to grow to $902.3 billion by 2027 at a steady 9.31% annual rate.

On the demand side, the market is equally massive. As of 2025, there are over 4.88 billion retail consumers globally. That corresponds to nearly 60% of the world’s population, with projections reaching 5.6 billion by 2030.

In a market this large, competitive, and dynamic, access to high-quality retail data is no longer optional. It is a strategic necessity. Retail data enables companies to understand pricing trends, monitor competitor activity, track inventory availability, identify changes in consumer preferences in near real time, and much more.

For example, an ecommerce brand can use pricing and availability data to spot when a competitor runs out of stock and adjust its own pricing to capture demand. Likewise, sales and customer behavior data help retailers anticipate seasonal demand, optimize promotions, and avoid costly overstock or stockouts.

Overcome Retail Data Retrieval Challenges with a Specialized Data Provider

With the steady rise of online shopping, gathering retail data may seem easier than ever, thanks to web scraping. In the United States alone, 95% of Americans shop online at least yearly, generating massive volumes of publicly available retail data.

In practice, however, retrieving retail data at scale is far from simple. Data collectors face several persistent challenges:

- Inconsistent product page structures: Retail websites, and even pages within the same site, use different layouts, schemas, and naming conventions. This makes it difficult to build reliable and reusable data parsing logic, potentially asking for AI web scraping.

- Scale and fragmentation: The same products are often sold across hundreds of online retailers. That requires robust systems to deduplicate, normalize, and aggregate data in order to achieve high-quality results.

- Anti-bot protections: Major retailers like Amazon, Walmart, and eBay deploy CAPTCHAs, IP bans, rate limiting, and bot detection systems that actively block automated web scraping bots.

- Data freshness requirements: Prices, availability, and promotions change frequently, forcing scrapers to run continuously without triggering detection or downtime.

- Operational complexity: Maintaining infrastructure, proxies, retries, and monitoring pipelines demands ongoing engineering effort and costs.

Given these obstacles, building an in-house retail data collection system is rarely the most efficient option. As a result, many companies rely on specialized retail data providers. These solutions handle data extraction, infrastructure, and compliance, making retail data accessible through two main methods:

- Retail datasets: Pre-collected, structured, and regularly updated data covering historical prices, products, inventory, and promotions across retailers. They are ready for immediate analysis and ML/AI training.

- Retail scraping APIs: Endpoints that extract retail data at scale in real time, handling proxies, anti-bot systems, and parsing while returning clean, standardized outputs. They can generally be integrated into AI agents as external tools or AI-powered development solutions.

What to Look for in a Retail Data Provider

By leveraging a retail data provider, you can focus on generating insights and making decisions instead of managing the complexity of data collection. At the same time, the sheer number of providers on the market can be overwhelming.

To identify the most reliable solutions, you need to compare them across common factors such as:

- Data breadth: The types and scope of retail data offered by the provider.

- Information sources: Where the data company collects its retail data, including online stores, marketplaces, and partner integrations.

- Infrastructure: The provider’s ability to scale, maintain uptime, handle large volumes of requests, and ensure high data success rates.

- Integration with AI: Support for connecting retail data to AI agents, workflows, and pipelines.

- Freshness of data: The availability of historical and/or real-time up-to-date retail data.

- Technical requirements: Skills, tools, or infrastructure needed to access, process, and integrate retail data.

- Data governance: Ensuring that the retail data provider follows relevant privacy frameworks like GDPR and CCPA.

- Pricing: Availability of subscription plans, custom packages, trials, and sample datasets for evaluation.

Top 6 Retail Data Providers

Explore the list of the best retail data providers, carefully selected and reviewed according to the criteria presented earlier.

1. Bright Data

Bright Data is the world’s leading web data platform, powered by enterprise-grade infrastructure. Unlike other providers that offer static data or non-scalable architectures, it delivers a limitless, real-time, infinitely scalable ecosystem.

That infrastructure supports many use cases, including modern retail data use scenarios via:

- Retail datasets: Enriched and validated datasets delivered in JSON, CSV, or Parquet, allowing you to skip the data collection process entirely. These datasets contain millions of records and are built for deep historical analysis, competitive benchmarking, and optimized for machine learning model training and LLM ingestion. Every dataset includes key fields such as SKU, pricing history, inventory status, rating distributions, seller details, and customer sentiment.

- Retail Scraper APIs: Scraping endpoints with an additional no-code interface to extract information on demand at scale from retail platforms. Anti-bot bypassing and IP rotation are fully automated, ensuring a 99.99% success rate. Supported domains include Amazon, Walmart, Google Shopping, AliExpress, Target, and IKEA.

- Bright Insights: Built on Bright Data’s massive infrastructure, this service provides actionable intelligence. Supported strategic use cases include price intelligence, MAP (Minimum Advertised Price), share of voice, market share, digital shelf optimization, and revenue optimization.

With over 150 million proxy IPs, Bright Data offers the most ethical, compliant, and robust data collection environment in the world. This supports businesses of all sizes, from boutique brands to Fortune 500 companies.

Together, these capabilities position Bright Data as the best retail data provider!

➡️ Best for: Enterprise-grade retail data collection and analytics, seamless AI integrations, and machine learning model training.

Data breadth:

- Purchase history, service data, and customer behavior patterns extracted from retail datasets.

- Initial price, final price, discounts, currency, historical price records, and competitor price monitoring.

- Reviews, reviewer names, ratings, feedback, and purchase behavior trends.

- Units sold, top-selling products, category-level sales, revenue indicators, and market share analysis.

- Stock counts, low-stock indicators, availability per SKU, inventory optimization insights, and replenishment trends.

- Product name, brand, description, category, attributes (size, color, material), matched/similar products, and visual tags/images.

- Discounts, flash sales, promotional monitoring, MAP insights, and campaign-driven price deltas.

- Marketplace and platform-specific availability, country code, root domain, and store information.

- Digital shelf visibility, search ranking, assortment performance, and product trend tracking.

Information sources:

- Amazon, Shopee, Walmart, TikTok Shop, Shein, Google Shopping, eBay, Home Depot US, Etsy, Zara, Target, H&M, Naver, Costco, and 50+ additional global retailers.

Infrastructure:

- Scalable data collection with 150M+ proxy IPs across 195 countries.

- Support for unlimited concurrency.

- 99.99% uptime and success rate for scraping APIs.

- Advanced anti-bot measures, including IP rotation, CAPTCHA solving, and custom HTTP headers for uninterrupted access.

- Bulk data extraction to handle 5k URLs per request.

- Flexible dataset delivery in JSON, NDJSON, CSV, Parquet

- Dataset on Amazon S3, Google Cloud, Snowflake, Azure, SFTP, Pub/Sub, Webhooks, and other channels.

- Advanced dataset filtering and segmentation tools that let you focus on the most relevant data, streamline analysis, and reduce costs.

- Validated, cleaned, enriched, and LLM-optimized datasets ready for AI or analytics workflows.

- Access to a repository of petabytes of cached data, including retail store information, via the Web Archive API service.

- 24/7 dedicated support from data experts to ensure smooth operations and guidance.

Integration with AI:

- Supports 70+ AI solutions and frameworks, including LlamaIndex, LangChain, CrewAI, Dify, Agno, AWS Bedrock AI Agents, IBM Watsonx, Microsoft Copilot Studio, and many others.

- Natural language filtering to describe your data needs in plain English and let AI automatically apply precise filters.

- Simplified integration in AI agents for retail analytics via Web MCP.

Freshness of data:

- Historical and trend data available through pre-built datasets with flexible update schedules (daily, weekly, monthly).

- Real-time retail data collection via API-based and no-code scraping tools.

Technical requirements:

- Basic technical knowledge sufficient to start collecting standard retail data via APIs.

- No-code scrapers enable simplified data extraction directly from the Bright Insights platform.

- Familiarity with APIs recommended for advanced automation, custom workflows, or integration with BI tools.

Data governance:

- Fully compliant with GDPR and CCPA.

- Certified to SOC 2 Type II, ISO 27001, and other security standards.

- Data sourced ethically from publicly available web retail information only.

Pricing:

- Free trial available + sample retail datasets.

- Retail data scraping starts at $1.50/1k records.

- Retail dataset pricing starts at $2.50/1k records.

- Flexible subscription plans start from $1,000/month for high-quality insights from Bright Insights.

2. GroupBWT

GroupBWT is a data engineering and software development firm that delivers enterprise-grade data solutions. For retail, it provides direct API access with smart fallback scraping. That system allows you to retrieve SKU- and store-level insights, promotion tracking, digital shelf monitoring, historical pricing, and more. The provider also features structured data exports in JSON and CSV.

➡️ Best for: Business intelligence pipelines for retail analytics.

Data breadth:

- SKU-level prices, MSRP (Manufacturer’s Suggested Retail Price), sale prices, historical pricing baselines, rollbacks, campaign-driven deltas, flash-sale monitoring, promo codes, coupon logic, urgency tags, influencer bundles, and campaign mapping by region/device.

- Stock counts, low-stock tags, per-store, geo-based, city-, or ZIP-level availability, replenishment trends, SKU lifecycle monitoring, regional assortment audits, and store-specific SKU differences.

- Product attributes, claims parsing, visual tags, standardization across stores, and local rollout monitoring.

- Search rank, digital shelf visibility, share-of-shelf metrics, keyword mapping, seller attribution, source URLs, timestamps, and audit-ready outputs.

Information sources:

- Amazon, Walmart, eBay, Sephora, Boots UK, Rossmann.de, Zalando, Target, Best Buy, and Costco.

Infrastructure:

- Direct API access with smart fallback scraping for uninterrupted data collection.

- Support for mobile app extraction on iOS/Android and JavaScript-heavy pages.

- Built-in IP rotation, dynamic HTTP headers, and CAPTCHA handling.

- Structured, BI-ready data delivered via JSON, CSV, API, S3, or SFTP.

Integration with AI:

- Basic integration by wrapping APIs into AI tools.

- Official technology for custom AI chatbot development.

Freshness of data:

- Real-time syncs for pricing, stock, promotions, and digital shelf positioning.

- Hourly, daily, or custom frequency based on SKU velocity and business needs.

- Historical pricing information for trend analysis.

Technical requirements:

- Basic programming or data-handling skills required for API integration.

- Data analysis skills recommended for exploring database exports via SQL, Tableau, Power BI, or Looker.

Data governance:

- GDPR, CCPA, and local privacy law compliance built into pipelines.

- Audit-ready logs, consent enforcement, and traceable SKU metadata.

Pricing:

- Free 30-minute audit to scope the project before quoting.

- Costs vary by number of platforms, SKU volume, sync frequency, and source type.

- From a few hundred USD/month for basic needs to $5K–$50K+ for enterprise needs.

3. Retail Scrape

Retail Scrape is a data company specializing in providing end-to-end retail data intelligence solutions. It combines managed web scraping services, scraping APIs, structured datasets, and analytics to help retailers, brands, and distributors make smarter decisions. Its services include competitor price monitoring, product data extraction (pricing, stock, reviews, and attributes), MAP compliance tracking, and customer sentiment analysis.

➡️ Best for: Retail data acquisition projects, where access to hundreds of vertical sources is fundamental.

Data breadth:

- Price tracking with historical trends, promotional offers, discounted prices, dynamic pricing optimization, and MAP compliance monitoring.

- Customer reviews, ratings, feedback, sentiment insights, and structured datasets for consumer behavior.

- Bestseller lists and sales performance metrics.

- Stock and product availability, inventory levels, SKU monitoring, and replenishment trends.

- Comprehensive product information, including names, descriptions, categories, brands, SKUs, UPC/EAN, specifications, images, variants, dimensions, colors, sizes, material types, and featured products.

- Shipping details, delivery options, and delivery time estimates.

- Digital shelf and purchase behavior insights, including review patterns, assortment, and visibility metrics.

Information sources:

- Amazon, Myntra, Walmart, eBay, Best Buy, Shopware, Alibaba, Shopee, Target, AliExpress, Etsy, Rakuten, ZARA, Wish, and 150+ others.

Infrastructure:

- API-based web scraping infrastructure.

- Support for scheduled scraping, with real-time, hourly, daily, weekly, or custom frequency options.

- Advanced scraping algorithms with HTML cleaning.

- Data validation processes to ensure accuracy before delivery via cloud, FTP, or email.

- Data sent in CSV, JSON, XML, and SQL formats.

Integration with AI:

- Built-in support for AI-driven price optimization, predictive analytics, product matching, trend insights, market intelligence, and automated reporting.

Freshness of data:

- Real-time updates and scraping for pricing, stock, and promotions.

- Historical review and pricing datasets available.

- Customizable refresh rates depending on business needs.

Technical requirements:

- Basic knowledge of data handling and coding skills for API integration.

- Data analysis or data science skills recommended for use with BI tools, dashboards, or analytics.

- No technical skills required if using fully managed scraping services.

Data governance:

- GDPR and CCPA compliant.

Pricing:

- Prices for basic datasets start at $20.

- Pricing is customized and scales based on platforms, volume, and frequency (contact the company for a quote).

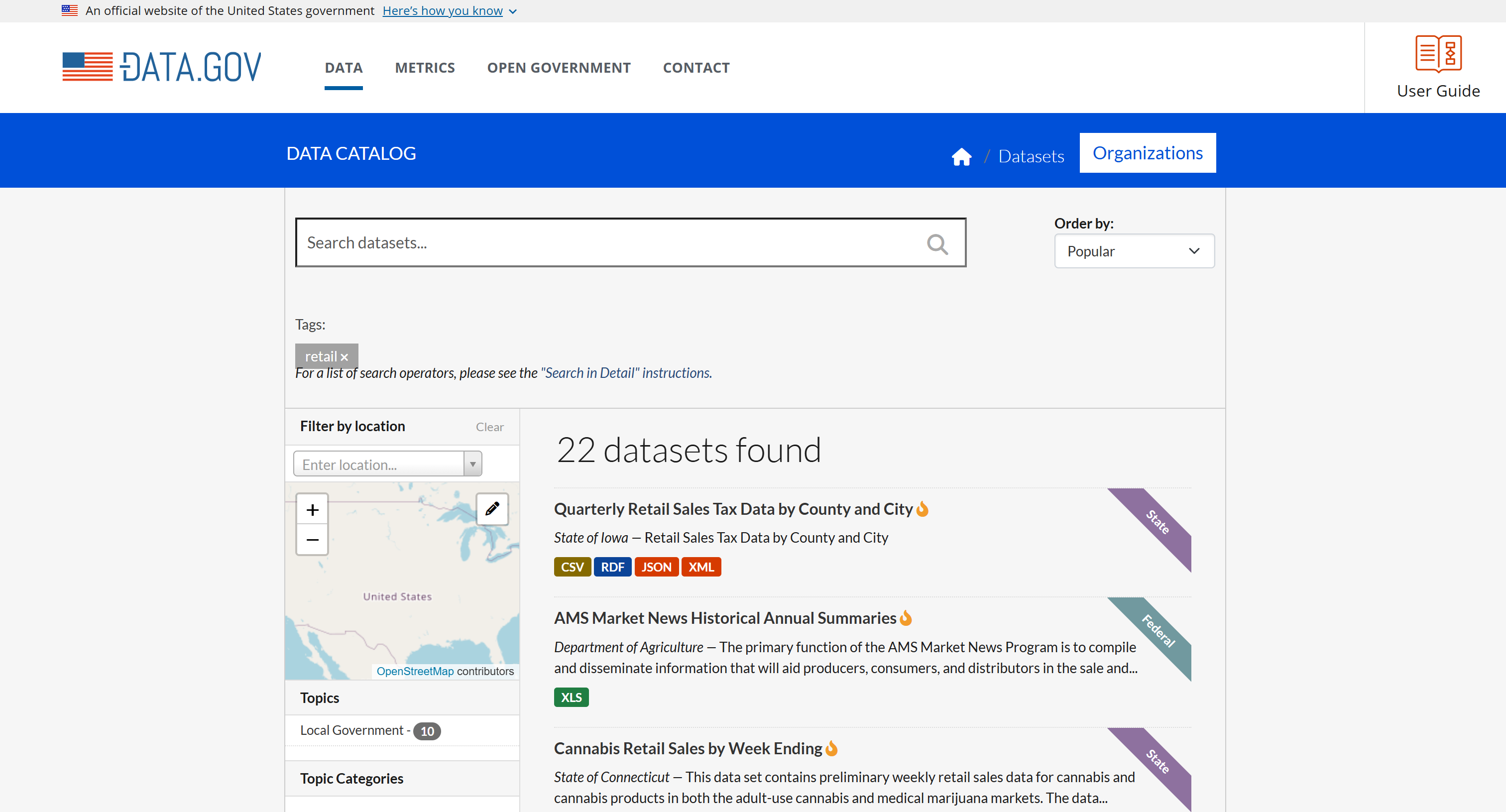

4. Data.gov

Data.gov is the U.S. government’s centralized open data portal. To drive transparency, innovation, and research, it offers public, machine-readable access to federal datasets. When it comes to retail data, it provides 22 datasets covering sales, pricing, store counts, grantee locations, cannabis and tobacco retail, and energy-related retail data. Data is available in multiple formats, supporting AI/ML projects, analytics, and trend analysis.

➡️ Best for: AI/ML data training, experimentation, and proof-of-concept projects.

Data breadth:

- Weekly, quarterly, and historical retail sales data for various goods by region, city, or county.

- Average residential retail prices for several commodities, including historical annual summaries and trend data.

- Storefront vacancy surveys, medically licensed retail locations, total number of retail establishments by state/city, and retail grantee locations.

- Tobacco advertising studies capturing marketing practices likely to attract children.

Information sources:

- Federal: Department of Agriculture, Department of Energy, Department of Labor, National Renewable Energy Laboratory, etc.

- State: New York, Connecticut, California, Maryland, Iowa, etc.

- City/County: New York City, Philadelphia, Allegheny County, District of Columbia, etc.

Infrastructure:

- Manual dataset downloads, with files available in CSV, JSON, XML, RDF, XLS, PDF, HTML, ZIP, GeoJSON, and KML formats.

- API access available via Data.gov API.

Integration with AI:

- Datasets can be used for AI model training.

Freshness of data:

- Varies by dataset, with some that are updated periodically (weekly or quarterly), while others are static.

Technical requirements:

- Depending on the chosen dataset, required skills range from basic data handling to advanced data analysis.

- Basic web skills may be needed to access data via the API.

Data governance:

- Compliance with the U.S. Federal Data Strategy.

Pricing:

- Free access to all datasets.

5. Roboflow

Roboflow is an end-to-end computer vision platform. In particular, it equips you with tools to build, train, and deploy vision-based machine learning systems at scale. For retail scenarios, it comes with visual datasets for shelf monitoring, inventory visibility, product recognition, and promotion detection. The platform provides managed dataset hosting, AI-assisted labeling, automated training, APIs, and edge deployment.

➡️ Best for: Computer vision–based machine learning solutions designed for retail use cases.

Data breadth:

- Image-based inventory visibility through computer vision datasets, including on-shelf availability, empty shelves, shelf gaps, cooler stock, pallet detection, and in-store inventory monitoring inferred from photos and videos.

- Visual product data derived from labeled images, covering SKUs, packaged goods, groceries, beverages, apparel, footwear, furniture, household items, barcodes, logos, and brand recognition.

- Visual identification of promotional elements such as sale signs, discount tags, and featured placements within retail images.

- Visual datasets related to pallets, packages, warehouses, and inventory handling, and more.

Information sources:

- User-uploaded visual datasets from multiple sources.

- Synthetic and augmented visual data.

Infrastructure:

- Cloud-based platform for hosting, labeling, versioning, and managing large-scale computer vision datasets.

- API first architecture for dataset access, model training, deployment, and inference.

- Support for automated data pipelines enabling continuous image ingestion and model retraining.

Integration with AI:

- Native support for training and deploying computer vision models, including object detection, classification, segmentation, and tracking.

- Integrates with popular ML frameworks and workflows, enabling real-time visual intelligence for retail use cases like shelf monitoring and inventory visibility.

- Enables AI-driven insights from images and video rather than traditional tabular retail data.

Freshness of data:

- Historical retail image datasets, with continuous dataset updates supported.

Technical requirements:

- Intermediate to advanced machine learning or computer vision knowledge required for model training and tuning.

- Coding skills needed for dataset management and hosted inference, with more advanced expertise required for custom pipelines or edge deployments.

- Suitable for both technical teams and non-experts through managed workflows available directly on the platform.

Data governance:

- Depends on usage.

Pricing:

- Subscription-based plans:

- Public: Free tier with up to $60 per month in free credits.

- Core: $99 per month with $60 in free credits and additional features.

- Enterprise: Custom pricing.

6. Dataseeders

Dataseeders transforms web data into practical insights, providing cutting-edge web scraping solutions that empower businesses with accurate and timely information. Its retail offerings include competitor pricing, product inventory, promotions, store locations, customer reviews, and distribution data, enabling price monitoring, trend analysis, and hyperlocal market intelligence.

➡️ Best for: Non-technical teams that need ready-to-use retail data.

Data breadth:

- Retail store location data, including store addresses, geolocations, branches, franchises, facilities, operating status, openings, and closures.

- Competitor pricing data with real-time price monitoring and price change alerts.

- Product stock and inventory availability, highest-selling product indicators, promotions, deals, offers, and brand distribution tracking.

- Customer reviews, ratings, and sentiment signals related to products and store services.

Information sources:

- Thousands of retail websites and platforms worldwide, including mobile applications.

Infrastructure:

- Managed web scraping services with end-to-end data collection and processing.

- Structured data delivery in the desired output format.

Integration with AI:

- AI and machine learning used internally for data validation, enrichment, and quality assurance.

Freshness of data:

- Real-time scraping options for dynamic retail data.

- Retail datasets delivered as ready-to-use outputs.

Technical requirements:

- No scraping infrastructure or tooling required from you, as data collection is fully managed.

- Data analysis skills needed to explore and interpret retail data.

Data governance: Undisclosed.

Pricing:

- Custom pricing based on data requirements, platforms, scale, and use case (quote-based engagement via direct consultation).

Conclusion

In this article, you explored the immense value of retail data and why partnering with a specialized provider is a strategic advantage. Top-tier retail data providers deliver results through curated datasets or API-driven solutions that either hook into centralized repositories or scrape live information.

Among the industry leaders, Bright Data distinguishes itself with an enterprise-level infrastructure and tools designed for the AI era. Its retail-specific solutions include:

- Retail datasets: Millions of records, such as pricing history, SKU details, inventory levels, and customer sentiment from dozens of retail websites.

- Scraper APIs: Scraping endpoints for on-demand extraction of live data from giants like Amazon, Walmart, eBay, and many others.

- Bright Insights: A specialized intelligence layer that transforms raw data into strategic reports on market share, MAP compliance, and digital shelf performance.

Sign up for a Bright Data account today for free to start discovering our web data services!

FAQ

Where to get retail data?

You can get retail data from a mix of government sources, aggregators, or directly from e-commerce websites. Popular options include Data.gov for U.S. public datasets, Amazon, Walmart, Target, eBay, Zalando, Etsy, as well as Shopify stores, Best Buy, Costco, Wayfair, Alibaba, and local retail chains’ APIs or public feeds for product, pricing, inventory, and sales insights.

How to retrieve retail data?

Retail data providers typically offer data through two main options.

- Prepackaged datasets: Curated collections that include historical sales, pricing, store locations, and inventory trends. They are ideal for trend analysis, forecasting, or benchmarking across regions and product categories.

- Direct site collection: Scraping tools that capture data directly from e-commerce sites, marketplaces, or brand portals. Alternatively, they are APIs that give you access to a centralized database. In both cases, they provide current information on prices, stock levels, promotions, and reviews, offering a live snapshot of market conditions.

What is a retail dataset?

A retail dataset is a structured snapshot of the market. It is available as a file containing semi-structured data, which can include product details, historical sales, price changes, store information, and promotions. Depending on the provider, the dataset may be updated regularly or remain static, making it either a historical reference or a near-real-time tool for analysis.

How to scrape retail data?

Each retail platform is unique, so there is no one-size-fits-all approach to retail data collection. However, at a high level, you can follow this general scraping roadmap:

- The scraper connects to the target retail website or marketplace.

- The page is rendered using a browser automation tool or parsed with an HTML parser.

- It applies data extraction logic to select HTML nodes and pull the relevant information. Since product pages (even within the same site) can vary widely, this process often uses AI-powered parsing to improve effectiveness.

- The collected data is then structured and exported in the desired format (JSON, CSV, etc.).

For step-by-step guidance, refer to the tutorials: