In this guide to the best sales tracker tools, you will learn:

- What a sales tracker tool is

- What companies look for in a sales tracking platform

- A curated list of the top sales tracker tools of the year, spanning market intelligence and CRM-based trackers

- A summary table for quick comparison

To start things off, let’s begin with what a sales tracker tool is.

What is a Sales Tracker?

A sales tracker is a tool that helps businesses monitor all sales activity in one place. It pulls data from sources like CRMs, e-commerce platforms, and analytics tools, showing teams how sales are performing and where action is needed.

Today, many sales trackers also monitor the wider market-tracking trends, pricing changes, and competitor moves to help companies understand their position. Internally, CRM-based tracking keeps teams informed about pipeline health and deal progress.

Combining both internal and external sales tracking gives businesses a clear view of performance and market conditions, helping them make smarter, quicker decisions.

What Businesses Look for in Sales Tracker Tools

Businesses expect sales tracker tools to give them a clear and dependable view of their performance. Because these platforms support daily decisions, companies focus on features that help them work with accurate data, understand trends, and connect everything they use in one place. The key factors include:

Data accuracy

A tracker must present information that reflects what is happening in real time. This includes reliable market data, consistent pipeline updates, and clean historical records.

Strong integrations

Companies use CRMs, marketing platforms, e-commerce systems, and analytics tools. A good tracker connects to these systems without extra work or manual data entry.

Clear reporting and visualization

Dashboards should highlight patterns, show performance at a glance, and make it easy for teams to share insights across the company.

Forecasting and analytical capability

Many teams rely on predictive insights to plan for demand, manage quotas, or understand changes in the pipeline.

Scalability

The tool should support more data, more users, and more complex reporting as the company grows.

Support and guidance

Businesses look for helpful documentation, responsive support, and onboarding that makes adoption smooth for the entire team.

These elements help companies choose tools that match their needs and offer long-term value.

With these factors in mind, we can now go ahead to look at the tools that stood out this year.

Top 10 Sales Tracker Tools

The tools in this list were selected using the criteria outlined above, with attention to data accuracy, integration options, reporting quality, and overall usability. The list includes a mix of market intelligence platforms and CRM-based trackers, since many companies rely on both to understand their performance and the conditions around them.

Below are the top sales tracker tools of 2026, each bringing a different set of strengths depending on the needs of the business.

1. Bright Insights

Bright Insights is a built for companies that need reliable visibility into how products perform across major e-commerce marketplaces. It provides verified data at scale, allowing teams to benchmark their products against competitors, categories, and regions with a level of accuracy that many traditional tracking tools cannot match.

A core strength of Bright Insights is its ability to report competitive benchmarks that reflect how e-commerce performance is measured. Bright Insights uses AI-driven modeling and verified marketplace data to estimate SKU-level sales performance and category share. This gives brands a clear understanding of how their products stack up against competitors across different regions and categories.

Bright Insights also provides pricing benchmarks that help teams monitor MAP alignment across sellers and identify unusual pricing activity or potential margin risks. Its competitor tracking covers marketplace search visibility and key product-page content signals, including ratings and reviews, so teams can understand shifts in competitor presence and identify areas that may need attention.

Key features: AI-assisted revenue modeling, SKU-level sales velocity, MAP compliance benchmarks, competitive search ranking insights, product page performance signals, real-time dashboards

Best suited for: Brands and retailers that rely on accurate e-commerce benchmarks to guide pricing, strategy, and competitive positioning

Notable strengths: Highly accurate market modeling and benchmark data designed specifically for e-commerce competitive intelligence

2. Profitero

Profitero is focused on giving brands an up-to-date view of how their products perform across online retailers. It collects daily e-commerce data and turns it into benchmarks that show where a product stands within its category and what is affecting its performance. Companies use it to understand sales estimates, digital shelf conditions, and how competitive pressure is shifting across major marketplaces.

Profitero’s modelling provides SKU-level estimates for sales and share across supported retailers. This helps teams evaluate how their products compare to competing items and if changes in demand or seller activity are influencing their position. The platform also tracks price movements, stock status, search placement, ratings, and review trends so brands can see which factors are contributing to wins or losses in their category.

Key features: SKU-level sales and share estimates, daily digital shelf checks, search visibility insights, pricing and stock monitoring, review and rating analysis

Best suited for: Brands that need frequent marketplace data to guide decisions across pricing, assortment, and channel strategy

Notable strengths: Broad retailer coverage and consistent daily updates that give teams a clear view of category performance without relying on manual checks

3. GfK Market Intelligence

GfK Market Intelligence is known for its point-of-sale (POS) data, giving companies a direct view into how products perform across retail channels. Unlike tools that rely on modeled or inferred data, GfK collects transactional information from retail partners, which provides a grounded benchmark of what is actually selling, where it is selling, and how quickly performance is shifting. This makes it especially valuable for brands in consumer electronics, appliances, and fast-moving goods.

GfK Market Intelligence reports benchmarks such as sell-out volume, average selling price, regional penetration, and category share across major retailers. These benchmarks help teams identify which regions or product variants are outperforming or underperforming market expectations. GfK’s time-series data also highlights seasonal patterns, replacement cycles, and emerging demand signals.

GfK’s strength comes from its access to structured, retailer-sourced data. This enables clear comparisons against the broader market, helping brands understand whether sales changes are unique to them or part of a wider trend.

Key features: Sell-out tracking, average selling price benchmarks, regional performance insights, time-series trend analysis

Best suited for: Brands with retail distribution that need authoritative market benchmarks

Notable strengths: Verified POS data and deep category-specific reporting

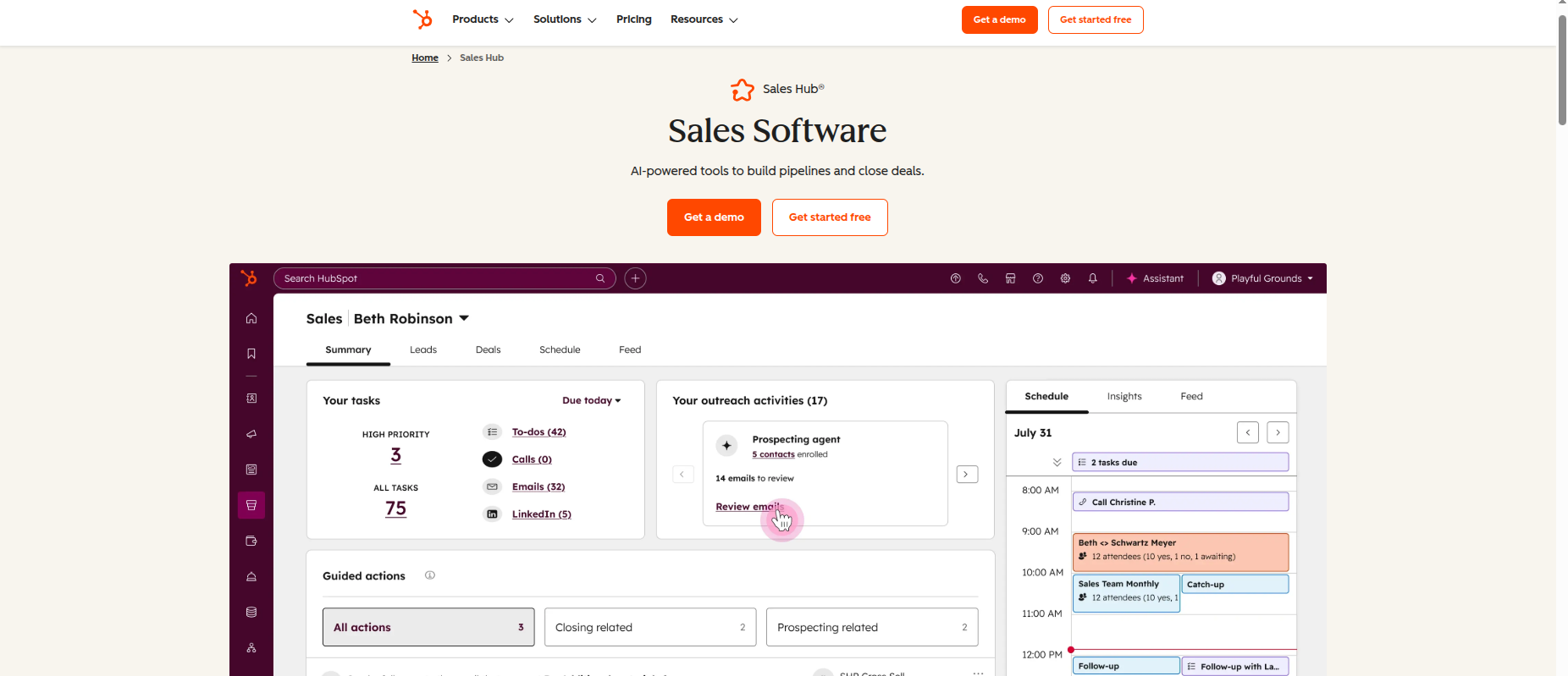

4. HubSpot Sales Hub

HubSpot Sales Hub is a CRM platform designed to help teams organize their pipeline, track customer interactions, and measure day-to-day sales activity. It is widely used by growing businesses because of its clean interface and the way it integrates sales, marketing, and service tools in one environment. For teams that want a reliable internal view of their performance, HubSpot offers a strong combination of usability and depth.

HubSpot Sales Hub provides benchmarks such as win rate, deal velocity, pipeline coverage, and rep activity performance. These metrics help managers understand how efficiently deals move through each stage, where prospects are stalling, and whether the team has enough pipeline to hit future targets. HubSpot also highlights performance trends across outreach volume, meeting effectiveness, and email engagement.

Its reporting tools allow teams to break down performance by representative, segment, or product. This makes it easier to identify strengths, gaps, and opportunities for coaching. The platform is well-suited for companies that want to align sales and marketing efforts without adding operational complexity.

Key features: Deal tracking, sales activity benchmarks, pipeline analytics, integrated communication tools

Best suited for: Teams that want a unified CRM environment for organizing and measuring sales activity

Notable strengths: Strong usability and tight integration across the HubSpot ecosystem

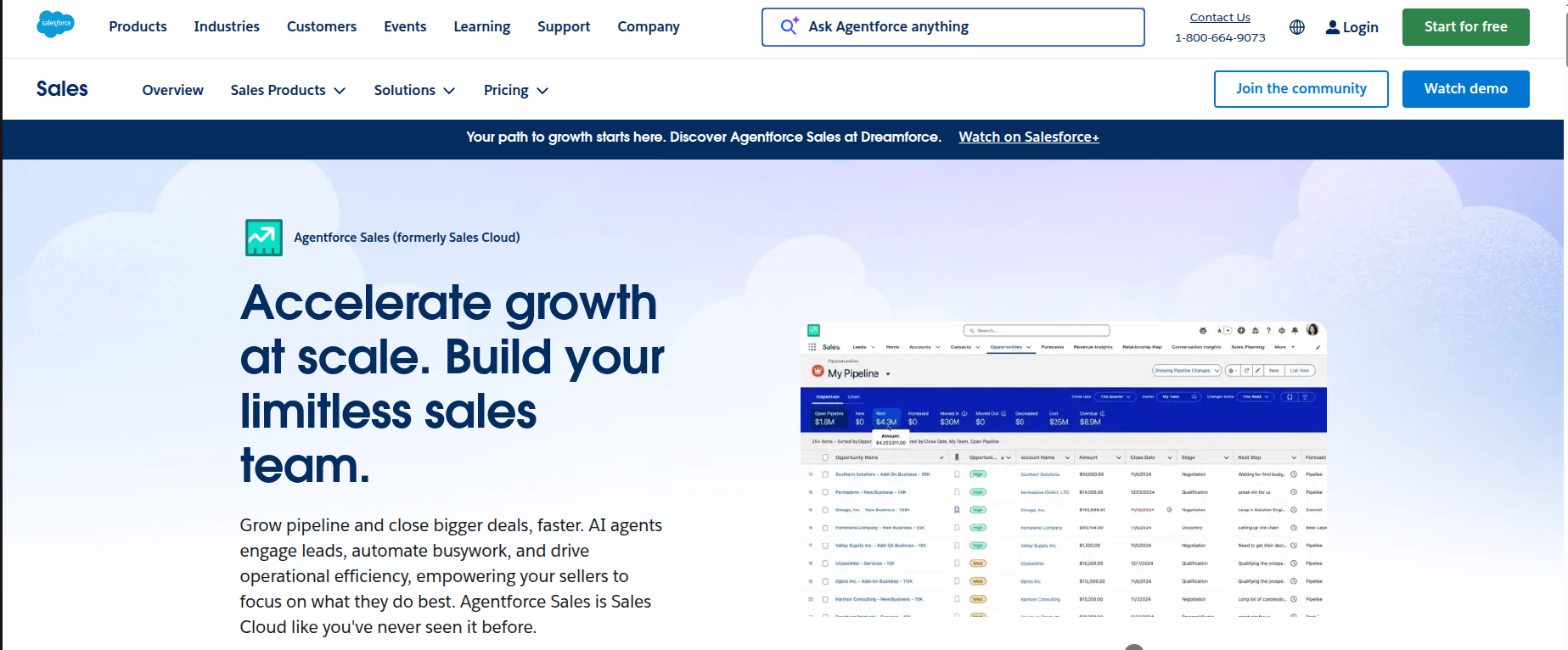

5. Salesforce Sales Cloud

Salesforce Sales Cloud is an enterprise-level CRM platform built to support complex sales operations across multiple regions, teams, and product lines. It is known for its customization options and extensive ecosystem, which allow companies to shape the platform around their sales process rather than adjusting their workflow to fit the tool. For large organizations that need structure, control, and depth, Salesforce remains one of the most widely adopted systems.

Salesforce Sales Cloud provides detailed performance benchmarks such as forecast accuracy, pipeline aging, stage-by-stage conversion rates, and quota attainment trends. These metrics help teams evaluate whether their pipeline is healthy, where deals tend to slow down, and how close the company is to reaching future targets. Salesforce also highlights segment-level performance, allowing leaders to compare how different regions, teams, or industries are responding to market conditions.

Because the platform connects customer records, sales activity, communications, and forecasting models, teams can drill into the details behind each benchmark to understand the underlying factors driving performance.

Key features: Advanced forecasting, conversion benchmarks, customizable dashboards, workflow automation

Best suited for: Enterprises that need a deeply configurable CRM with strong governance and reporting

Notable strengths: Extensive ecosystem and robust analytics for large, distributed teams

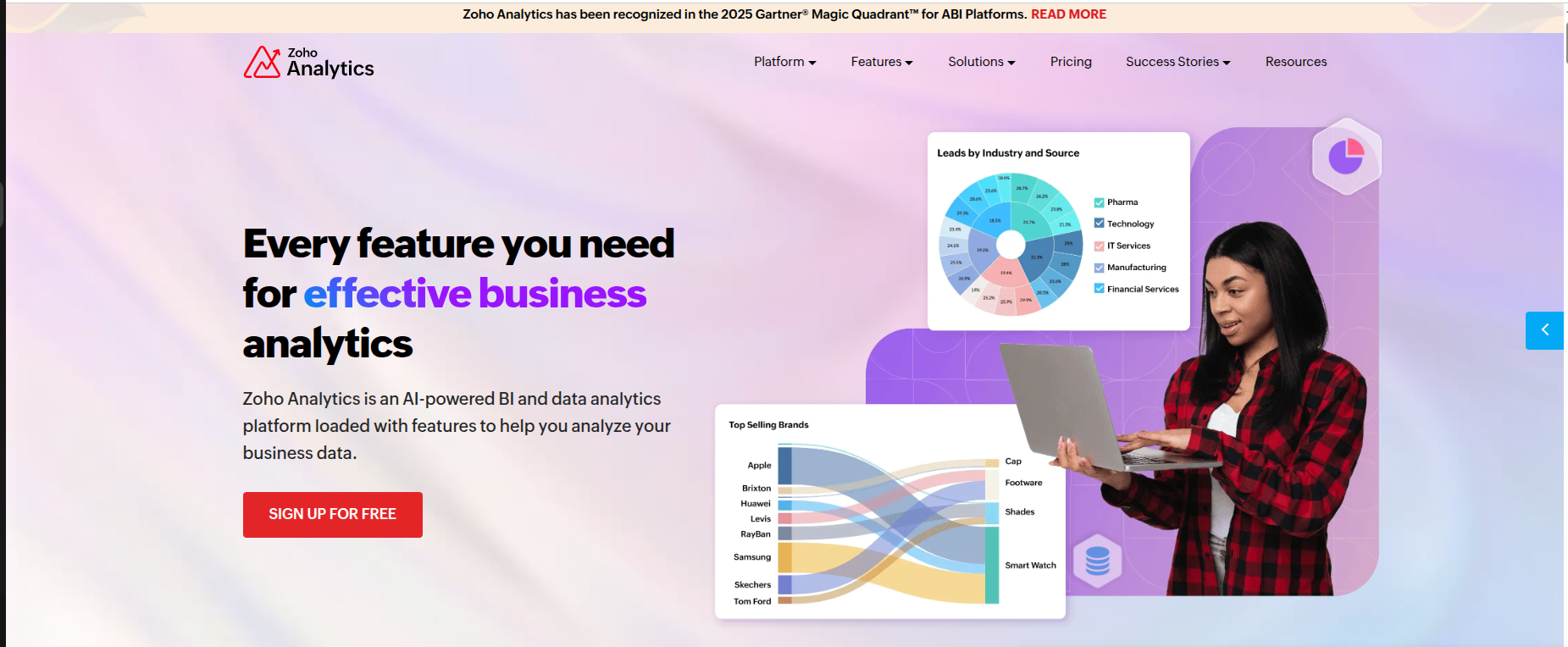

6. Zoho Analytics

Zoho Analytics is a reporting and business intelligence platform that helps companies bring together data from their CRM, marketing tools, finance systems, and online stores. It is often chosen by teams that want flexible dashboards without the cost or complexity of larger enterprise suites. Because it connects multiple data sources, Zoho Analytics gives businesses a consolidated view of their sales and operational performance.

Zoho Analytics tracks benchmarks such as lead-to-deal conversion rates, sales cycle length, average deal size, and channel contribution across email, paid campaigns, and organic traffic. These metrics help teams understand how efficiently they generate and close opportunities, which channels drive the most meaningful results, and how different products or segments contribute to overall revenue.

Zoho Analytics also supports custom KPIs, allowing teams to build dashboards tailored to their goals. This is useful for companies that need to monitor specific metrics such as recurring revenue, churn patterns, or territory-level performance.

Key features: Cross-platform data blending, customizable dashboards, AI-assisted insights, detailed conversion benchmarks

Best suited for: Teams that want flexible reporting across sales, marketing, and finance data

Notable strengths: Strong customization and accessible pricing.

7. Clari

Clari is a revenue intelligence platform built to help companies understand the health of their pipeline and the accuracy of their forecasts. It is widely used by revenue operations teams because it brings together data from CRMs, communication tools, and activity logs to highlight where deals are gaining momentum and where they may be at risk. The platform focuses on clarity and predictability, which makes it valuable for organizations that depend on precise forecasting.

Clari reports benchmarks such as forecast accuracy, pipeline coverage ratio, deal slippage rate, and engagement strength based on how often prospects interact with the sales team. These metrics help leaders judge whether their current pipeline can support upcoming targets and where additional activity is needed. The platform also highlights risk indicators, such as stalled communication or lack of stakeholder involvement, which can signal weakening deal confidence.

Clari’s strength lies in its ability to uncover patterns that traditional CRM reporting often misses. By showing which deals are truly moving and which ones only appear active, the tool helps teams prioritize time and resources.

Key features: Forecast accuracy benchmarks, deal health scoring, pipeline coverage analysis, activity-based insights

Best suited for: Revenue operations teams that rely on precise forecasting and risk detection

Notable strengths: Strong predictive modeling and clear visibility into pipeline behavior

8. Pipedrive

Pipedrive is a visual CRM designed to help sales teams stay organized and maintain steady activity throughout their pipeline. Its simple layout and drag-and-drop workflow make it easy for teams to track deals, understand where prospects stand, and keep daily tasks on schedule. It is a popular choice for small and mid-size businesses that want a lightweight tool without sacrificing visibility.

Pipedrive provides benchmarks such as deal progress rate, activity-to-deal ratio, pipeline velocity, and task completion consistency, which help managers identify how consistently the team is working the pipeline. These metrics show whether representatives are maintaining enough outreach, whether deals are moving at the right pace, and where follow-ups may be falling behind.

Pipedrive also allows teams to compare performance across products, stages, or territories, which helps identify patterns that affect conversion. Because the tool emphasizes action tracking, it is particularly useful for teams that want to build disciplined sales habits.

Key features: Visual pipeline tracking, activity benchmarks, deal movement insights, automation rules

Best suited for: Teams wanting a simple, action-focused CRM

Notable strengths: Clear pipeline visibility and strong alignment between activity and outcomes

9. Gong

Gong is a conversation intelligence platform that analyzes sales calls, meetings, and emails to show teams what drives successful customer interactions. It is used heavily by sales enablement and revenue teams because it highlights patterns in messaging, objection handling, and deal momentum that are difficult to track through CRM activity alone. The platform provides a direct look at how prospects respond during the sales process and how those responses impact outcomes.

Gong tracks benchmarks such as talk-to-listen ratio, question frequency, topic coverage, and engagement depth, allowing teams to compare high-performing calls to those that need improvement. It also measures deal risk indicators, including declining communication, reduced stakeholder involvement, and sentiment changes across conversations. These insights help managers understand not just what the team is doing, but how effectively they are doing it.

The tool’s strength comes from its ability to link communication patterns to actual deal results. This allows companies to coach with concrete examples, tighten messaging, and identify behaviors that consistently lead to higher win rates.

Key features: Conversation analytics, deal risk signals, messaging consistency insights, coaching tools

Best suited for: Teams focused on improving sales quality through behavioral data

Notable strengths: Clear visibility into communication patterns that influence deal outcomes

10. Close CRM

Close CRM is built for teams that rely heavily on outreach and need a fast, communication-focused workflow. It combines calling, emailing, SMS, and pipeline management in one interface, which makes it popular among remote teams and fast-growing startups that want a simple system without extra layers of configuration. The platform is designed to reduce the number of tools representatives switch between during the day, keeping attention on activity and follow-up.

Close tracks benchmarks such as daily outreach volume, call connection rate, response rate, and follow-up consistency, helping managers understand how consistently the team is engaging prospects. It also measures conversion by touchpoint, showing whether email, SMS, or phone calls produce the strongest outcomes. These signals help teams refine their outreach strategy and focus on channels that deliver the best results.

Because Close keeps communication and deal tracking in one place, teams can quickly see how outreach quality connects to pipeline progress. This gives smaller teams a practical, straightforward way to maintain momentum.

Key features: Built-in calling and messaging, activity benchmarks, communication timelines, simple deal tracking

Best suited for: Remote and fast-moving sales teams focused on high-volume outreach

Notable strengths: Streamlined communication workflow and clear activity visibility

Summary table

| Tool | Category | Best For | Key Benchmarks or Strengths |

|---|---|---|---|

| Bright Insights | Market intelligence | Companies that need marketplace visibility | SKU-level sales estimates, category share modeling, MAP monitoring, marketplace search visibility, product page signals |

| Profitero | Market intelligence | Brands tracking digital shelf and marketplace performance | Daily SKU sales estimates, category benchmarks, price and availability tracking, search rank, ratings and reviews insights |

| GfK Market Intelligence | Retail POS intelligence | Sell-out tracking across regions and categories | POS sell-out volume, average selling price benchmarks, regional penetration, category trends |

| HubSpot Sales Hub | CRM-based tracker | Pipeline visibility and rep activity tracking | Win rate, deal velocity, pipeline health, rep activity patterns |

| Salesforce Sales Cloud | Enterprise CRM | Large, multi-region sales operations | Forecast accuracy, stage conversion, pipeline aging, quota progress |

| Zoho Analytics | BI and reporting | Multi-source dashboards and KPI modeling | Lead-to-deal conversion, cycle length, blended data sets, custom KPI reporting |

| Clari | Revenue intelligence | Forecast precision and pipeline risk detection | Pipeline coverage ratio, deal slippage indicators, engagement strength, predictive scoring |

| Pipedrive | CRM-based tracker | Visual pipeline tracking for SMBs | Activity-to-deal ratio, pipeline velocity, deal movement rate |

| Gong | Conversation intelligence | Sales coaching and communication analysis | Talk-to-listen ratio, topic coverage, buyer engagement depth, deal correlation |

| Close CRM | Communication-focused CRM | High-volume outreach and remote teams | Outreach volume, connection rate, channel-level response trends |

Final Thoughts

Sales teams work best when they have clear information to guide their decisions. Each tool in this list offers a different way to track performance, understand trends, and stay aligned with changing conditions.

When accuracy matters most, Bright Insights delivers verified marketplace intelligence you can trust. Built on Bright Data’s award-winning infrastructure spanning 150M+ residential IPs across 195 countries, Bright Insights provides SKU-level data that reflects real market conditions, not estimates. This precision is only possible through enterprise-grade data collection that ensures compliance, reliability, and scale.

With the right platform in place, companies can move with confidence and make decisions backed by dependable market intelligence. Book your demo now.